Menu

Double Emergence: Cicadas Taking Over Midwest

Amanda Olsen

April 12, 2024

Sloth Saga Enters New Phase

Cole McDonnell

April 5, 2024

Death Of LI Cop Ignites Conversations On Policy Change

Lauren Feldman

March 29, 2024

Opponents Of ‘Blakeman’s Militia’ Rally In Mineola

Janet Burns

April 12, 2024

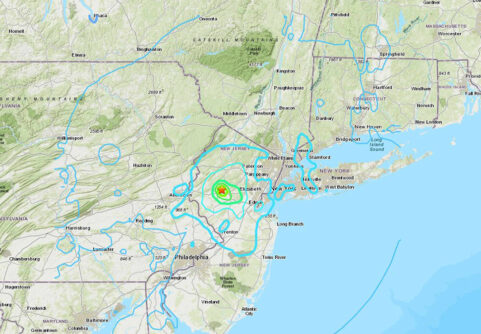

Rare Earthquake Shakes The Region

Anton Media Group Staff

April 5, 2024

Total Eclipse 2024

Amanda Olsen

April 5, 2024

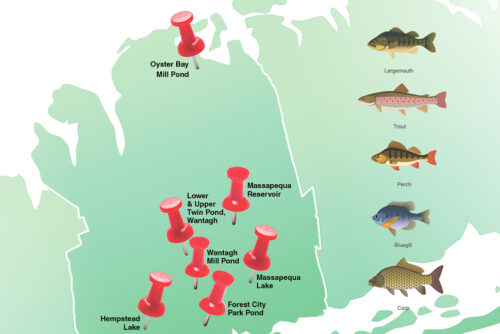

Freshwater Fishing In Nassau

Amanda Olsen

April 1, 2024

Can The MTA Manage $15 Billion Carryover Capital Projects With The Next $51 Billion Or More

Larry Penner

April 15, 2024

Shine A Light For Charity On The INN

Kayla Donnenfeld

April 15, 2024

The Big Move

Marisa Cohen

April 15, 2024

We Would Not Miss MS

Patty Servidio

April 8, 2024

LOCAL EDITIONS

TRENDING

Ukrainian Rocker Talks

Fundraising For Friends,

25 Years Of Touring

Gogol Bordello to play free benefit

in Tompkins Square Park

By Cory Olsen – April 15, 2024

THIS WEEK'S

SPECIAL SECTIONS